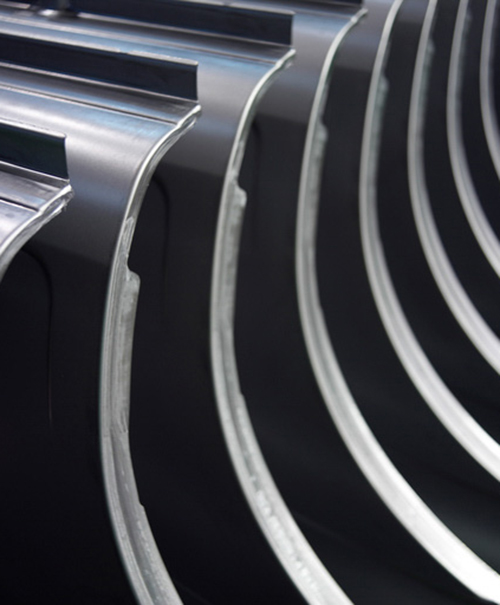

OF ALL the threats facing the global economy, none has more destabilizing potential than China’s decelerating growth rate. After years of booming by exporting and investing, the People’s Republic has begun accumulating debt and excess industrial capacity; yet the Communist leadership in Beijing seems unwilling or unable to make the necessary transition to greater reliance on services and domestic consumption. China’s bloated state-run industries, especially steel and aluminum, are desperately trying to raise cash by flooding the United States and Europe with cheap products, a global fire sale that threatens jobs in those countries, triggers retaliatory measures — and adds to geopolitical tensions already high over the maritime boundary dispute in the South China Sea.

The United States and China this month concluded their annual “strategic and economic dialogue” in Beijing, and Treasury Secretary Jack Lew took the occasion to warn his hosts in terms that were relatively blunt, by the standards of such confabs. “Excess capacity has a distorting and damaging effect on global markets,” he said, and “implementing policies to substantially reduce production in a range of sectors suffering from overcapacity, including steel and aluminum, is critical to the function and stability of international markets.” In response, China pledged “to undertake further steps,” even as senior officials protested that they shouldn’t be blamed for overcapacity because it resulted from China’s stimulus spending during the global financial panic in 2008 — for which it was praised by the United States and Europe…